St. Kitts and Nevis citizenship by investment

The leading citizenship program in the Caribbean

- Investment amount — from USD 250,000

- Processing time — from 6 months

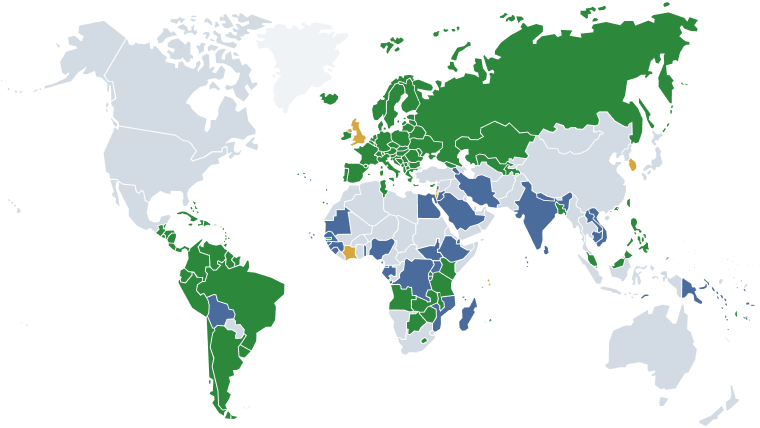

- Visa-free access — over 145 countries

The leading citizenship program in the Caribbean

Unlock your options — consult with an expert today

The Federation of St. Kitts and Nevis offers the world’s oldest economic citizenship program, successfully operating since 1984. Over four decades, the initiative has undergone thorough reviews by international organizations and proven its stability, making it a preferred choice for affluent families.

The program provides flexible investment options tailored to different needs and investor strategies. Applicants can choose between a non-refundable contribution to the Sustainable Island State Fund, the purchase of real estate in government-approved tourism projects, or an investment in a private residence for personal use.

Get the guide to obtaining St. Kitts and Nevis citizenship

A safeguard against political and economic risks in the country of primary residence.

No personal income tax on worldwide earnings, no inheritance tax, and no capital gains tax.

Citizenship is fully inheritable with no time limits, offering access to prestigious universities and global prospects.

149 countriespassport mobility

149 countriespassport mobility

20thpassport power ranking

20thpassport power ranking

Unlock your options — consult with an expert today

A non-refundable contribution to the government’s Sustainable Island State Fund (SUF) provides a simple and fast route to citizenship. Fund resources are directed toward infrastructure, healthcare, education, and other socially significant projects in the federation.

Primary investment:

Due diligence fees:

Invest in shares of resort complexes, hotels, or residential projects approved by the government. This option allows partial recovery of the investment and steady rental income.

Minimum direct investment: USD 325,000 with resale permitted after 7 years.

Additional government fees:

Due diligence fees:

Purchase a private home for personal use, offering complete freedom of ownership outside commercial projects.

Minimum investment: USD 325,000 for a condominium unit or shared property, or USD 600,000 for a single-family home.

Additional government fees:

Due diligence fees:

Invest in strategically important projects that diversify the federation’s economy and create local jobs.

Main applicant: USD 250,000 minimum contribution to an approved public benefit project.

Due diligence fees:

Specialists from Mirsatori analyze the client’s case and determine the optimal investment route: a contribution to the Sustainable Island State Fund, the purchase of real estate in an approved project, acquisition of a private residence, or investment in public benefit projects.

Request a consultationMirsatori specialists select the program and prepare the document package for obtaining an ID card.

Mirsatori lawyers register legal entities in jurisdictions with favorable tax conditions.

Specialists of Mirsatori choose a bank, prepare documents, and ensure account opening.

Mirsatori lawyers assist with citizenship applications for spouses, children, and parents.

Specialists of Mirsatori handle certificates of no criminal record, birth certificates, and other necessary documents.

The Mirsatori team selects properties, reviews their history, negotiates terms, and provides legal support for transactions.

St. Kitts and Nevis

St. Kitts and Nevis

São Tomé and Príncipe

São Tomé and Príncipe

Grenada

Grenada

Dominica

Dominica

Get your personal investment plan

São Tomé and Príncipe

São Tomé and Príncipe

Grenada

Grenada

Dominica

Dominica

The minimum investment is USD 250,000 for a single applicant through a contribution to the Sustainable Island State Fund. Additional government fees and charges range from USD 50,000–USD 70,000.

If you choose the real estate option that costs starting from USD 325,000, the property can be sold after 7 years to another program participant, allowing partial recovery of the invested funds. A contribution to the Sustainable Island State Fund is non-refundable, but it offers a lower entry threshold.

The minimum timeframe is 6 months from the submission of the complete document package. Due diligence checks take approximately 6–10 weeks.

No. The entire procedure is handled remotely through an authorized agent. After obtaining citizenship, there are no residency requirements.

Obtaining citizenship does not automatically make you a tax resident of St. Kitts and Nevis. Tax residency is determined by the time physically spent in the country. The federation does not tax income earned outside its territory.

Fill out the form to schedule a meeting in the office or online

Unlock your options — consult with an expert today