Antigua and Barbuda citizenship by investment

Caribbean citizenship unlocking seamless global mobility

- Investment amount — from USD 230,000

- Processing time — from 6 months

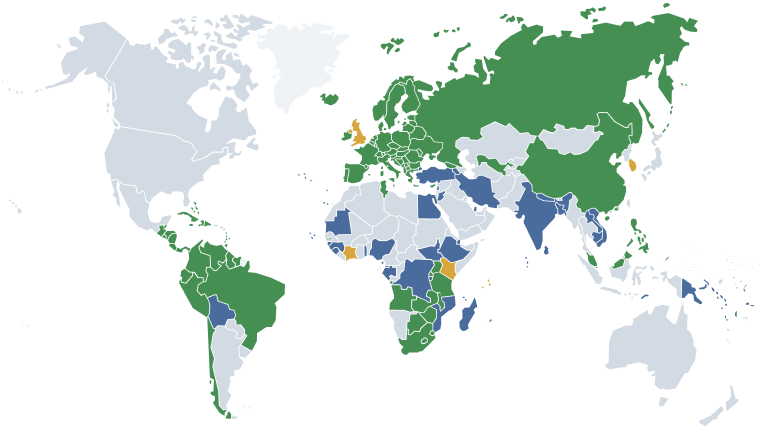

- Visa-free access to 140+ countries

Caribbean citizenship unlocking seamless global mobility

Unlock your options — consult with an expert today

Launched in 2013 under the Citizenship by Investment Act, 2013, the Antigua and Barbuda program is overseen by the government’s Citizenship by Investment Unit (CIU), which is responsible for processing applications and conducting thorough due diligence.

Applicants are not required to pass language or history exams, maintain permanent residence in the country, or renounce their current citizenship. To qualify, investors must select one of the approved investment routes and undergo a comprehensive background check. Once approved, participants are required to spend a minimum of five days in Antigua and Barbuda within the first five years to maintain citizenship.

Get the guide to obtaining Antigua and Barbuda citizenship

Caribbean citizenship opens access to new markets and simplifies international business travel with visa-free entry to 143 countries.

Children of Antigua and Barbuda citizens enjoy advantages when applying to universities in the United Kingdom and other Commonwealth nations.

Antigua and Barbuda citizenship provides an alternative place of residence in case of political or economic instability.

143 countriespassport mobility

143 countriespassport mobility

25thpassport power ranking

25thpassport power ranking

Unlock your options — consult with an expert today

A non-refundable donation to the government fund, supporting infrastructure and social programs.

Additional fees:

Purchase property in government-approved projects with a minimum holding period of 5 years.

Additional fees:

Special option for families of 6 or more, including one free year of tuition for a family member.

Additional fees:

Invest in a new or existing government-approved business project.

Additional fees:

Mirsatori specialists conduct a detailed analysis of your situation, verify compliance with program requirements, and develop an optimal citizenship strategy. At this stage, potential challenges are identified, and solutions are proposed to maximize the chances of success.

Request a consultationSpecialists at Mirsatori will develop a strategy based on your new status, help optimize taxes, and make the most of available benefits.

Mirsatori lawyers register legal entities in jurisdictions with favorable tax conditions.

Specialists of Mirsatori choose a bank, prepare documents, and ensure account opening.

Mirsatori lawyers assist with citizenship applications for spouses, children, and parents.

Specialists of Mirsatori handle certificates of no criminal record, birth certificates, and other necessary documents.

The Mirsatori team selects properties, reviews their history, negotiates terms, and provides legal support for transactions.

Antigua & Barbuda

Antigua & Barbuda

São Tomé and Príncipe

São Tomé and Príncipe

Grenada

Grenada

Dominica

Dominica

Get your personal investment plan

São Tomé and Príncipe

São Tomé and Príncipe

Grenada

Grenada

Dominica

Dominica

The process of obtaining citizenship through the investment program typically takes from 6 months. This timeframe includes document preparation, submission of the application, comprehensive due diligence checks, review by government authorities, and issuance of citizenship certificates.

The minimum investment is USD 230,000 for a family of up to 4 under the non-refundable contribution to the National Development Fund option. Additional fees include due diligence checks and government processing fees, which vary depending on the number of family members included.

The application and approval process is conducted entirely remotely through a licensed agent. Personal presence is not required until the oath-taking ceremony, which can be completed online or at an Antigua and Barbuda consulate. After obtaining citizenship, participants must spend at least 5 days in the country within the first 5 years to maintain their status.

Yes, the program allows for a broad inclusion of family members. Spouses must be legally married to the main applicant. Children up to 30 years old must be financially dependent on the applicant. Parents and grandparents aged 55 and older must also be fully financially dependent on the main applicant.

Antigua and Barbuda offers an attractive tax regime with no taxes on worldwide income, capital gains, inheritance, or wealth for tax residents, making it an appealing option for international financial planning.

Fill out the form to schedule a meeting in the office or online

Unlock your options — consult with an expert today